Amount Paid: The exact amount of each Earnings item in the paycheck.Payroll Item: The name of the Earnings payroll item that is affected by the change.

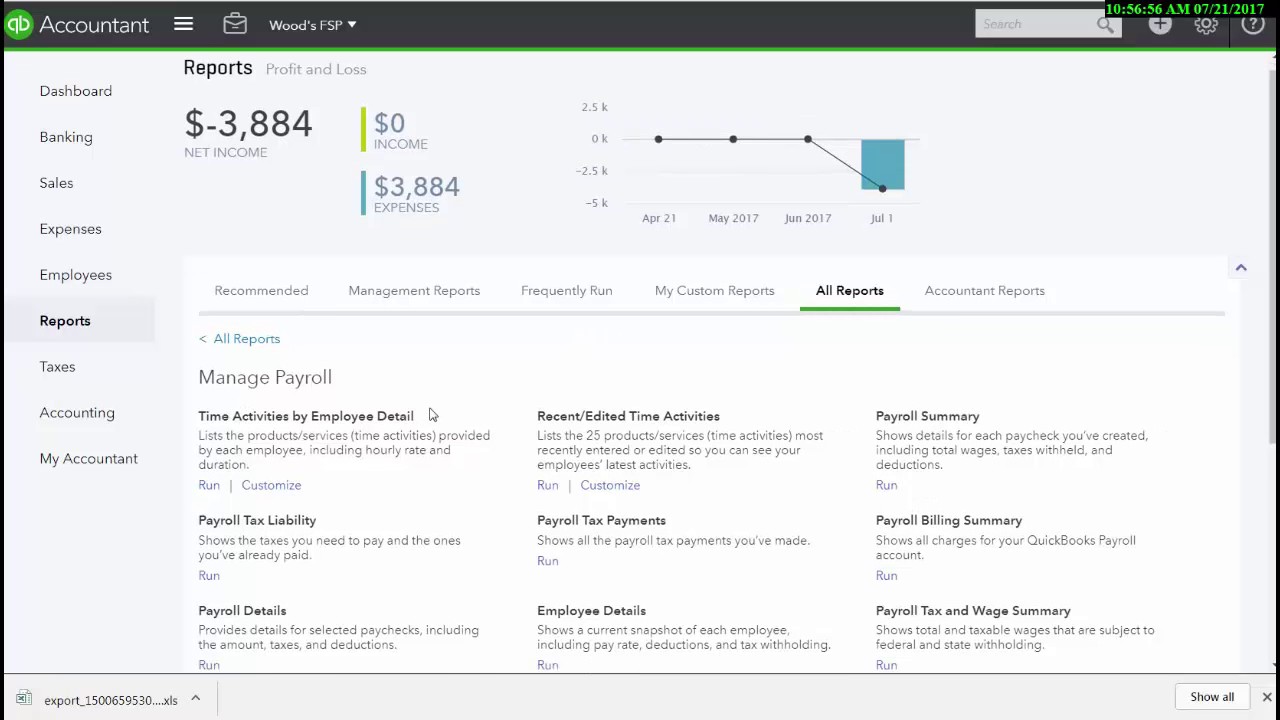

#Quickbooks desktop payroll reports how to#

This can be a positive/negative figure, depending on the change if it is a raise or a fall. QuickBooks Desktop Pro 2019 payroll will describe the payroll process for a small business in detail, so bookkeepers, accountants, and business owners can better understand how to set up payroll, process payroll, and troubleshoot problems related to payroll. % Change: The percentage rate of the change.Current Rate: The pay rate of the paycheck of the employee after the change.Previous Rate: The pay rate of the paycheck of the employee prior to the change.Paycheck Date: The date of the paychecks when the change came into effect.Pay Period : The pay period of the paychecks when the change came into effect. Intuit QuickBooks Assisted Payroll: Reports Payroll Reports Payroll Summary: This report shows the total wages, taxes withheld, deductions from net pay, additions to net pay, and employer-paid taxes and contributions for each employee on your payroll.This report features changes to the rate of the Earnings items in the paycheck, such as Salary, Hourly, Bonus and Commission. By default, if there’s a change in at least one of the Earnings items in the paycheck, all the Earnings items in that paycheck will be featured in the report to avoid misleading the customer into thinking that they have missing payroll items in the paycheck that they created. QuickBooks Pro 2019 Desktop payrollGo to the Employees menu at the top, then choose Payroll Center.Under the Create Paychecks table, select the Payroll tab.Choose the pay period you want to update.Click the drop-down arrow beside Payroll Schedules and choose Edit Schedule.Update the necessary fields and click OK. Click OK on the pop-up message that shows in your screen.

0 kommentar(er)

0 kommentar(er)